Newest draft of Power Development Plan VIII comes with several highlights

Stakeholders expect the latest draft of the Power Development Plan VIII (PDP 8) to be soon approved, paving the way to kick-start fresh investment projects in the power sector. Alternative power sources, particularly wind power and biomass power, have been proposed in the PDP 8.

In light of the Ministry of Industry and Trade’s latest draft which was submitted to the government on November 11, there are currently 12 coal-fired thermal power projects with a combined capacity reaching 13,792MW having been handed over to the investors.

These projects are either in the investment preparation phase or under construction and are divided into two groups.

Group 1 consists of seven projects under construction with a total capacity reaching 6,992MW. Of these seven projects, four have finalised capital arrangement; one in the process of negotiating with the full contractor for further implementation, and two have plans to borrow from domestic sources.

Group 2 consists of five projects in the investment preparation phase with a combined capacity amounting to 6,800MW. These projects are reported of facing difficulties in both capital arrangement and implementation.

These five projects are Cong Thanh (600MW), Quang Tri (1,200MW), Song Hau II (2,000MW), Nam Dinh I (1,200MW), and Vinh Tan III (1,800MW).

Of them, Cong Thanh meets the conditions to be removed from the list of coal-fired projects to shift into using liquefied natural gas (LNG) as a fuel.

Albeit existing issues with the four remaining projects, the has Ministry of Industry and Trade (MoIT) has suggested the prime minister to maintain these projects in the PDP 8, but presenting additional measures to prepare for all contingencies in case the projects couldn’t be materialised.

Accordingly, alternative power sources, particularly wind power and biomass power, have been proposed in the PDP 8.

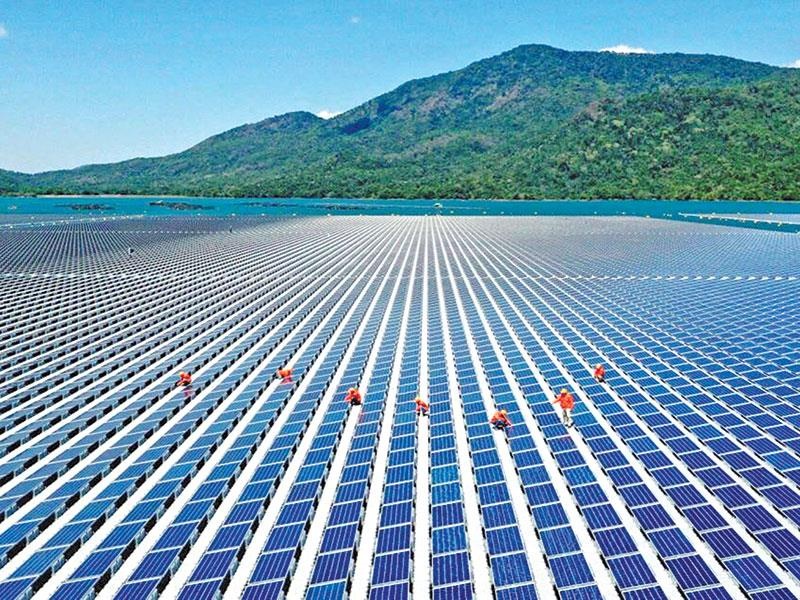

The latest draft has also recommended allowing further implementation of solar power projects and the approval of a new feed-in tariff scheme.

These projects, however, would be executed attuned to regional power network infrastructure and meet absorption capacity of the national power grid as the MoIT will trust Electricity of Vietnam (EVN) to check with each project.

In light of PDP 8's latest draft, the average power price (based on US dollar unit price in 2020) would be set going up gradually from 7.9 US cents/kWh by 2020 to around 8.1-9 US cents by 2030, and averaging 10.2-10.5 US cents by 2050, which are deemed lower compared to several regional countries like Indonesia and Thailand, according to the MoIT.

The wind and solar power rate is, however, going down and is forecast to be further reduced in the forthcoming time.

Taking reference to international forecasts, the PDP 8 estimates the rate for onshore wind power would retreat from 7.74 US cents/kWh in the period before 2025 to 6.35 US cents/kWh in the period before 2030, and lower further to 5.3 US cents/kWh before 2050.

For solar power, the rate would be shed to 5.5 US cents/kWh before 2030, and then 3.4 US cents/kWh before 2050.

“The latest draft has made larger revisions compared to numerous previous drafts, but it needs feasibility for implementation. For instance, if the price was not good, it would be hard to allure investors into executing new power projects. Vice versa, it would be hard for EVN if the selling price to power consumers could not cover the operating expenses. Therefore, the power rate issue must be put at prime importance to have power demand balance,” said Viet Anh, a senior energy expert.

Huong Thuy

Source: VIR

Original link