Apple suppliers spend billions diversifying from China

A recent research report from TD Cowen cited by newswire Appleinsider has revealed that Apple suppliers are diversifying their manufacturing bases from China as a result of production delays, the country's COVID-19 measures, problems with energy supply, and the ongoing trade tensions with the United States.

These concerns have led to Apple suffering a considerable loss of earnings as a direct result of China, further influencing this shift to other countries. "Over the last four years since the start of the pandemic, we estimate Apple's revenues have been impacted by over $30 billion," according to TD Cowen's report.

As a result, Apple and its 188 key suppliers are making investments to speed up the relocation plan. However, the plan also comes with a cost. It is estimated that Apple's suppliers have spent around $16 billion on diversifying production assets away from China to India, Mexico, the US, and Vietnam since 2018.

"While supplier relocation entails higher costs near-term, we believe there will be long-term cost benefits once the ex-China capacity is fully at scale," said the report. "We envisage a multi-year process before Apple sees full operating margin benefits as partners leverage the local labour pool."

TD Cowen estimates that it will take up to 18 months for a company to establish a new manufacturing plant, and potentially even longer to organise the whole supply chain. "If even one critical component cannot be produced away from the region that the supply chain is relocating from, then the move will only be partial," according to the analysis.

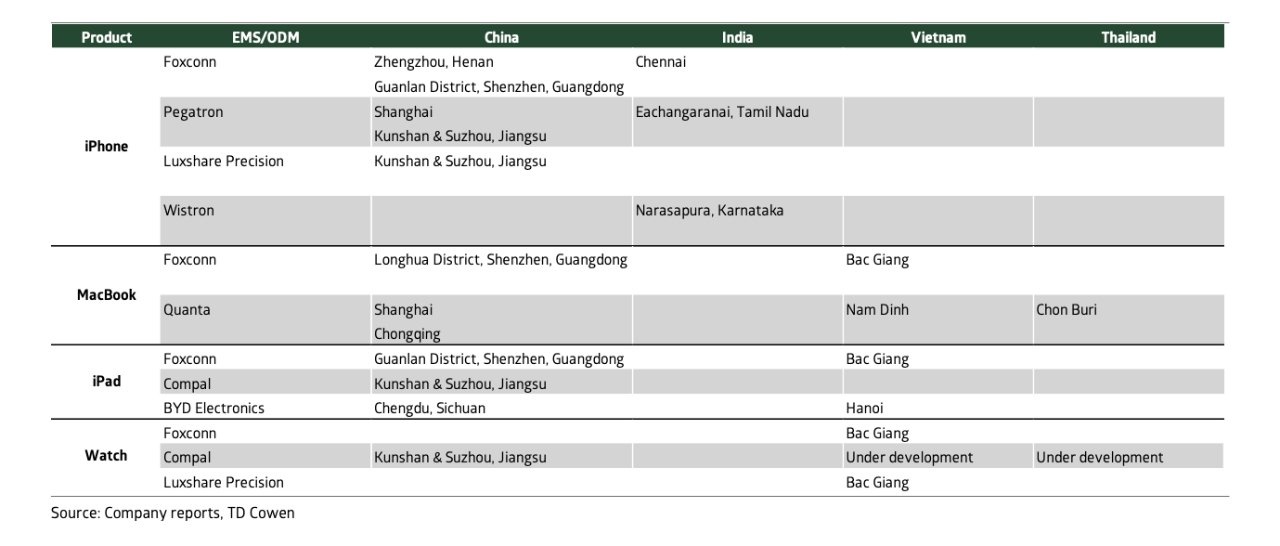

TD Cowen has analysed over 1,000 financial filings, using numbers from key firms such as Foxconn, Pegatron, Luxshare Precision, Wistron, and Compal. The majority of iPhone production remains centred in China, but recent investments in India are only just beginning to create a new manufacturing hub from which the company could export large volumes to the US. India is quickly becoming a major consumer of the iPhone, and increased localised production would reduce distribution logistics costs and improve affordability as import tariffs do not apply.

By contrast, Mac and iPad are making good headway with new manufacturing capacities in Southeast Asia. Supply chain field work suggests Vietnam has evolved into a major production hub for computers recently, and small volumes of MacBooks, iPads, and the Apple Watch are already being manufactured there.

TW Cowen estimates that capacity in Vietnam can support about 40 per cent of annual US Mac/iPad demand. While this is good progress, additional capacity is still required to meet US consumption needs.

|

By Thanh Van

Source: VIR

Original link