Please Login to use our services.

If you are not our member, please register here or contact us via email support@ipavietnam.org for our further support.

If you have not found the required data in our available reports above, please send us specific survey requests via email support@ipavietnam.org.

Based on your suggestions, our expert team will analyze and send you the report outline as soon as possible.

INDUSTRIAL PARK INFRASTRUCTURE DEVELOPMENT REPORT - CURRENT SITUATION AND DEVELOPMENT PROSPECT 2022

In the second quarter of 2022, the country’s GDP growth is estimated to increase 7.7% compared to Q2/2021 according to the calculations of the General Statistics Office of Vietnam. This is the highest Q2 growth rate in 10 years. In the context that the world situation is still complicated with inflation shock in many countries at the beginning of 2022 and Vietnam is in the first stage of growth after the pandemic, this growth finger is really impressive, showing that the economy is getting thriving. In which, more than 39% contributed to the increase from the Industry and Construction.

In the first 6 months of 2022, IIP in Vietnam increases about 9%, of which the manufacturing industry increases the most by about 10%. The total of the IIP and the manufacturing industry in 2022 are lower than the growth rate of the same period in 2021 and only higher than the rate of 2020, almost equal to the rate of the same period in 2018. Despite maintaining the growth rate from appearing the pandemic, the world’s price fluctuations, rare materials, especially the price of materials increases highly due to Russia-Ukcraine war and China’s Zero-covid policy has restrained the growth of product output.

Industrial land for rent is the most popular and oldest developed form of industrial real estate in Industrial Parks in Vietnam. Based on a survey of 258 active industrial parks, we found that 33% of the industrial land banks are leased for less than 50 USD/m2/lease period, and 26% of industrial parks with land leasing prices from 51-70 USD/m2/lease period. Especially in 2021, there have appeared a number of industrial parks with land leasing prices of more than 200 USD/m2/lease period, mainly in the South, although it only accounts for 3%, it also shows that the land rent has increased especially in the Southern Region in the past year.

Nowadays, ready-built factories are very attractive and have an increasing scale of investment capital but mainly towards the projects with a factory scale that is not too large and complicated as well as requires high technology. High-tech ready-built factories are tending to increase in recent years because the State has supporting policies, creating momentum for the development of high-tech industrial parks. However, this ratio is not much, and the fact that currently, high-tech industrial parks in Vietnam have not fully developed yet so they have not attracted many investors. Currently, Vietnam still mainly concentrates on the heavy industry with little high technology requirement so this type of real estate has not increased too fast. The increasing need of investors as well as the focus on the quality of factories of industrial park investors currently contributes to increasing more choices for the investors when referring to the industrial park market in Vietnam.

The new industrial parks in 2022

According to our data, in the first 6 months of 2022, about 27 new industrial parks are added to the country. In which, the Northern region is added the most with 15 parks, the Southern region is 7 parks and in the Central, there are 5 parks. In both quantity and planning areas, the new industrial parks in the North account for the majority, showing that the supply of provinces in the North is ready to take over new investment capital in the next years.

Status of some investment projects for the industrial park

Real estate of newly registered FDI projects in 2021 and the first 6 months of 2022 was very developed. Whereby, we can see that the trend of warehouse rental was raising both sides in a number of projects and registered investment capital. Especially in 2022, this trend is more and more clearly expressed when the number of warehouse rentals in the first quarter of 2022 raised 132% than the fourth quarter of 2021 and raised 193% over the same period of 2021. In the second quarter of 2022, the number of warehouse rental projects also raised 100% over the same period of 2021. The scale of investment capital of warehouse rental projects was also highly raised when the total registered investment of newly registered FDI projects in 6 months of 2022 up to 93% over the same period of 2021. Meanwhile, land lease projects were, on the contrary, both numbers of projects and investment capital scale were trending decreased.

In the first 6 months of 2022, we concluded that the textile industry was the industry that had many newly registered FDI projects. After that was: Electronic, metal, logistic, footwear,v..v. As we can see, textile was the industry that got much FDI capital in all 3 domains. Especially in central and southern, this was the industry that attract the most projects. And in northern, electronic and logistic was still top industry. This is completely matched with industrial park infrastructure in 3 domains. In Southern, a long time ago, textile was very developing because this was the convergence of many big textile projects, moreover, IPs from southern had a good infrastructure and an abundant number of workers. In northern, factories and warehouse for the logistic industry was very focusing on investment. Moreover, Nothern had a lot of IPs that invested in high-tech infrastructure, import of special electronic materials from China had many advantages in terms of geographical location, and traffic infrastructure had been improved so that it can attract FDI inflows in the electronic industry.

Industrial Parks attract most newly registered FDI projects in the first 6 months of 2022

When analyzed about the top 10 IPs, we conclude that from the beginning of the year until now, the Industrial Parks selection trend of FDI investors was still leaning towards the location of IPs that are convenient in terms of geographical location. When 80% of every industry is adjacent to the route and more than 50% of them only less than 30km from the port/airport/highway.

IMPLEMENTATION REPORT OF INDUSTRIAL PROJECTS IN VIETNAM QUARTER 3/2022

In the third quarter of 2022, the country’s GDP growth reached 13.67%, the highest in the third quarter of the last 5 years (2018-2022). The industry and construction sector and services, agriculture, forestry, and fishery sector also maintained an increase compared to the same period of last years. The total value of foreign direct investment capital into Vietnam in 9 months of 2022 is about 18.75 billion USD. The total registered capital of all newly registered, adjusted and contributed capital to buy shares projects decreased by more than 15% compared to the same period of 2021 and became the lowest number in the same period of the previous years. The sharp decline in world FDI, and geopolitical and economic conflicts led to a decrease in foreign investment capital.

Implementation Situation Of Vietnam Industrial Projects Q3 2022

In the third quarter of 2022, the whole country attracted about 90 newly FDI projects in the field of processing-manufacturing and warehouse construction sector. The number of projects increased 5% compared to the same period last year. However, in term of the amount of registered investment capital, in the third quarter of this year, the total amount of registered capital was only 70% of the attracted capital in the same period of 2021. The average capital of project also decreased by 36% over the same period last year.

Based on the newly investment FDI attracted into Vietnam from the beginning of 2022 until now, we see a decrease in registered investment capital from Q2 and maintained a slight decrease in Q3 (down by 3%) but the number of projects increased (Number of projects in Q3 increase by 25% compared to Q1 and Q2). We believe that in the fourth quarter of this year, both the number of projects and the scale of investment capital may increase slightly compared to the third quarter because this is the end of the year, investors, especially Chinese investors and Vietnam’s authorities tend to complete procedures at the end of the year.

Although ready-built factory (RBF) leasing is an increasing trend in 2021, in the third quarter of 2022 we see a slight decrease in RBF for lease projects compared to the same period in 2021. The land lease projects still account for the majority of newly invested FDI projects in Vietnam in the third quarter of 2022 (accounting for 73% of the number of projects) generally.

In this Report, we focus on analyzing projects that are in the process of being prepared for construction (Project preparation, design, bidding, main contractor selection) and projects under construction based on criteria: Type of construction, locality, type of projects, type of investment in the first 3 months of 2022 updated in our data system.

In the third quarter of 2022, projects under preparation and design stages accounted for the largest number and total investment among industrial projects. Due to the continuous increase of the cost of raw materials and fuel in recent years, leading to a great impact on construction costs, and the disruption of supply chains, which makes investors afraid to invest in projects.

INVESTMENT REPORT SUPPLY CHAIN LOGISTICS INDUSTRY IN VIETNAM 10M/2022

World FDI is on a downward trend from 2017 to 2021. Since 2017, the world FDI flows have changed continuously and there has never been a year that surpassed the number recorded in 2017. In 2021, global FDI flows recorded an increase of 30% compared to 2020 due to the controlled epidemic situation in many countries around the world.

However, entering 2022, global FDI is expected to be quite gloomy compared to 2021 due to investor uncertainty and risks from supply chain disruptions plus rising raw material costs and other risks from the global political and economic conflicts. This year, the global FDI is forecasted to be flat or down compared to 2021.

According to records in 2020, the global logistics market reached the largest scale in the Asia Pacific market with a nearby 4 trillion USD in market value. The Asia-Pacific region has long been an extremely exciting market for the logistics industry due to the concentration of many manufacturing plants, dense population, and high consumer demand. Next is North America and Europe region. In 2021, the global logistics market has recovered from the Covid-19 epidemic with a market size value of 9.53 billion USD (increased 17% compared to previous year). However, with the complicated developments of the macroeconomic situation and the inflation situation, the price of raw materials and fuels is forecasted to be still high in 2022, this market will also be significantly affected.

The Viet Nam economy in 2021 has suffered a severe decline due to the Covid-19 epidemic, by 2022, the economy is recovering. GDP in the third quarter increased by 13.67% over the same period in 2021. This Quarter 3’s GDP growth is the highest growth rate in a decade.

For transportation and warehousing services, the year 2021 was affected by the Covid epidemic and the policies of closing the borders of some countries, causing a negative growth in transportation and warehousing services. By 2022, the recorded number has improved since the beginning of the year until now, the growth rate of transportation and warehousing services is always positive and continuously increasing. This is a good sign for the economy in general and the transportation and warehousing industry which is gradually recovering after a period of severe impact from the epidemic.

In the first 9 months of 2022, Vietnam’s total import and export turnover reached more than 500 billion USD. Exports in the first 9 months of 2022 are estimated to increase by 17.3% and imports increased by 13% over the same period in 2021. The import-export in 9 months of 2022 reached a positive trade balance (surplus) exceeds 6.52 billion USD. In which, the domestic economic sector had a trade deficit of 22.89 billion USD, the foreign economic sector had a trade surplus of 29.41 billion USD. The foreign economic sector is still the area that accounts for the majority of Vietnam’s export markets.

The growth rate of warehouse transport in the period from 2010 to now has tended to increase rapidly, especially in recent years, the data we have collected shows strong growth. This shows that the logistics industry is making great progress, contributing greatly to the domestic economy. The Compound Annual Growth Rate (CAGR) in the period 2010-2021 reaches 23.64% (much higher than the growth rate of GDP of the country) and has shown a bright picture of the logistics industry in the Vietnam market. In the first 9 months of 2022, the growth rate of Vietnam’s transportation and warehousing industry increased by 14.2% over the same period in 2021, although in 2022, companies in the industry faces many difficulties with decreasing orders, costs are increasing, but with the explosion of e-commerce and efforts to stabilize the macro economy of countries in the world, it will help the logistics industry continue to achieve good growth in 2022 and also in the following years.

Logistics investment supply chain in Vietnam

Logistics is a specific business. Foreign direct investment (FDI) can only invest 100% in a few areas of the industry. Therefore, it can be clearly seen that FDI capital is focusing a lot on warehousing services and freight agency services. There are very few other services. Among them, freight agency service has the most registered investment projects and warehousing service is the field that attracts the largest amount of investment capital. The amount of investment capital in the field of warehousing always accounts for a large proportion of the fields of the Logistics industry (usually accounts for about 90% of the total investment capital) and tend to increase gradually over time. In which, cold storage is one of the niche markets with great potential for development in the future when cold storage investment projects appear continuously and the investment scale also tends to increase.

Potential Logistics projects in the future

According to our data, potential projects are more concentrated in the North (accounting for about 48% of the number of projects about to be deployed). The number of projects about to be deployed in the South is not much less (41%) and only about 11% of the projects are about to be implemented in the Central region. The North and the South continue to be two exciting regions of Logistics projects in the future. Especially most of them are projects in the preparation and design stages.

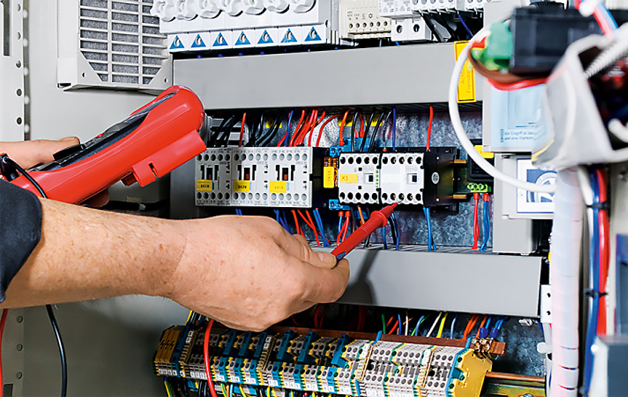

INVESTMENT REPORT SUPPLY CHAIN OF ELECTRICAL EQUIPMENT MANUFACTURING INDUSTRY VIETNAM 9M/2022

The Year of 2022 is the year that the world economy suffers many negative impacts. The consequences caused by the Covid-19 epidemic, the energy and food crisis caused by the Russian – Ukraine war, which pushed up prices and inflation rate, China is still carrying out the blockade measures to prevent the epidemic, which has made the economy during the 9 months of 2022 very bleak. Facing these economic risks, most of the experts forecasts the economy cannot be recovered in the next quarter, global economic growth still has many challenges in terms of politics, epidemics, and inflation, … In that context, the latest forecast of global GDP growth in 2022 will only fluctuate between 2,4%-3,2%.

World FDI is on a downward trend from 2017 to 2021. In 2021, global FDI flows increased by 30% compared to 2020. However, in 2022, global FDI is quite gloomy compared to 2021 due to the impact of uncertainly on investor behavior, risks from supply chain disruptions and the increasing of raw material costs and other risks from political and economic conflicts in the world. Global FDI is forecasted to be flat or down compared to 2021.

China is the largest exporter of electrical equipment in 2021 with 898,9 million USD, followed by Hong Kong with 395,5 million USD. In 6 years (2016 – 2021), China has always maintained the leading position in the export market of the electrical equipment industry. Besides, in terms of import market, in the five years of 2016 – 2020, the US is the leading country in the import market of electrical equipment, but by 2021, China has surpassed and become the world’s largest importer of electrical equipment.

Viet Nam’s GDP growth in the third quarter of 2022 is estimated to increase sharply by 13.67% over the same period last year according to the General Statistics Office (GSO). This is the highest Q3 growth rate over the past decade. In the context of complicated world situation with inflation shocks in many countries at the beginning of 2022 and Vietnam is just in the early stages of post-pandemic growth, the growth figure is very impressive, showing that the economy is thriving very clearly.

In the electrical equipment industry, electric wires and cables are among the most exported products. The export value of electric wire and cable products is still showing a clear growth trend. In 9 months of 2022, the export value of this product has a slight increase compared to the same period in 2021. China and the US are two major export markets of Vietnam in this industry.

Status of investment projects in the electrical equipment industry

Investment in the electrical equipment industry showed a continuous increase before 2020 but decreased during the period of the Covid-19 epidemic, so far there is no sign of a full recovery.

In terms of total investment capital, Vietnam’s electronics industry market records 5.5 billion USD in total registered capital and 339 total projects from 2013 to present and heavily depended on the big players in the industry, especially from FDI capital sources. The good news is in 2019 and 2021 recorded many large-scale capital investment projects. The capital flow over the years has fluctuated strongly, not in a clear increasing direction like the number of projects, but in general, there is an increasing trend. Crucially, DDI capital projects in recent years tend to be more flourish, both in 100% DDI capital projects and DDI-FDI capital joint ventures.

The North attracts the largest scale of registered investment capital and the most projects among three regions, especially in the provinces and cities of the Red River Delta economic region.

In term of the scale of registered investment capital, the registered capital in the electrical equipment industry, especially in large scale projects, is mainly located in the Northern provinces over most of the years. Except in 2019, the amount of capital poured mostly into the Southern provinces. Prominent provinces are Bac Giang, Quang Ninh and Ho Chi Minh city. The Central region has a significant project as Vines factory project in Ha Tinh. In which, processing and assembly projects account for the largest amount of capital.

In terms of the number of investment projects,

The North is the region with the highest concentration of electrical equipment projects followed by the South and the projects has scattered distribution in the Central. Since the Covid-19 epidemic appeared, the number of projects has decreased sharply and there is no prospect of recovery in 2022.

Some of the provinces and cities that attract many projects in the electrical equipment industry include Binh Duong, Dong Nai, Bac Ninh, Bac Giang and Long An. We can observe that among the top 5 provinces that attract the most projects, 3 are from the South. This shows that in terms of attracting the number of investment projects, there is not a clear distinction between the North and the South. But in the South, there are a few main provinces, while in the North, investment locations are selected and distributed more widely.

INVESTMENT REPORT VIETNAM SHOES AND LEATHER INDUSTRY Q2/2022

Currently, Vietnam is ranked second in the world in terms of leather and footwear exports, just behind China.

Specifically, each year Vietnam exports more than 1 billion pairs of shoes of all kinds to hundreds of countries around the world. In which, footwear exports to Europe accounted for the largest proportion of total export turnover.

By the end of 2021, there were about 2,200 footwear manufacturing enterprises, which are mainly located around Ho Chi Minh City.

Production and exports increase

Vietnam Leather, Footwear and Handbag Association (LEFASO) said that in July 2022, leather and footwear production only increased slightly by 3.2% compared to the previous month but increased by 25.5% over the same period in 2021. Generally in the first 7 months. the industry's production increased by 15.1% over the same period last year. The employment index in July 2022 also increased by 1.1% over the same period last month and increased sharply by 21.6% over the same period last year.

Exports in the first half of the year increased by 14.2% over the same period, reaching USD 13.81 billion, of which footwear exports reached USD 11.79 billion, up 13.3%; suitcase - bag - briefcase exports reached USD 2.02 billion, up 20%. Among the export markets of Vietnam's leather and footwear, North America experienced the strongest growth with 24.5%, Europe 15.7% and South America 10.8%. Export turnover decreased in the Asian market block with negative 6%.

According to statistics of the General Department of Customs, in August alone, the export turnover of footwear of all kinds reached USD 2.293 billion, up 0.9% over the previous month. In the first 8 months, the export of all kinds of footwear reached USD 16.368 billion, up 29.7% over the same period last year.

Thus, on average, footwear exports reached over USD 2 billion per month. With this base, the leather and footwear industry can fully achieve the export target of USD 22-23 billion in 2022.

The US is still the largest footwear import market of Vietnam, reaching USD 6,029.7 million, Belgium is the second largest market with USD 866.6 million, while China drops to the third position with USD 863.2 million.

According to LEFASO, Vietnam's footwear exports to markets with free trade agreements continued to see a positive recovery. In which, exports to the EU-Vietnam Free Trade Agreement member markets increased by 18.2%, and the UK market through the Vietnam - UK Free Trade Agreement increased by 10.9%.

In contrast, the market bloc of the Free Trade Agreement between Vietnam and the Eurasian Economic Union is still affected by the conflict between Russia and Ukraine, so the export growth decreased greatly to negative 57.7.

According to the General Statistics Office Textile industry: In Q1/2022, Vietnam’s yarn production as well as fiber and yarn exports decreased significantly. Specifically, the total yarn production in Vietnam in the first quarter of 2022 decreased by 3.2% compared to the same period in 2021. In which, the production of natural fibers decreased by 0.1% and the production of artificial fibers decreased by 5.0% over the same period. Fiber and yarn exports also showed signs of slowing down after a strong growth in 2021, export volume decreased by 9.0% in Q1/2022. However, because yarn prices remained high, export turnover still increased by 18.9% over the same period.

Besides, the textile dyeing industry also faced many challenges in Q1/2022. Specifically, production output in Vietnam in the first quarter of 2022 decreased by 4.1% compared to the same period in 2021 and only met about 25% of the total demands of the domestic market.

It can be seen that, up to the present time, the production activities of the Vietnamese fabric industry are still facing many difficulties. According to VIRAC, fabric production in Vietnam is still weak due to 3 main reasons. Firstly, the investment capital for each project is large, especially the technology and wastewater treatment systems are quite expensive, making the capital recovery time prolonged, leading to difficulties for medium and large enterprises. Small when wanting to invest in the industry. Secondly, the use of many chemicals in the printing and dyeing system can cause serious environmental pollution, so many localities have carefully considered or refused textile dyeing projects. Finally, domestic fabrics are mainly produced according to foreign designs, which makes fabric products in Vietnam lack creativity and reduce attractiveness to customers.

Forecast of textile and garment industry Q2/2022

The business results of the textile and garment industry in Q1/2022 have shown positive signs of recovery of the textile and garment industry after the 4th wave of the Covid epidemic. Accordingly, Vietnamese textile and garment industry in Q2/2022 is forecasted to have many prospects. Potential, especially for the garment industry. Besides the above growth drivers, Vietnam’s textile and garment industry will also face difficulties in terms of rising production costs. It is expected that the price of input materials for the textile industry such as cotton, fiber, yarn, and fabric will continue to increase; and logistics costs such as container prices and transportation costs have not shown any sign of decreasing. The increase in production costs will cause difficulties for businesses, especially when many businesses face financial difficulties.

Positive Recovery Potential

In 2022, textile and garment production has a stable positive outlook thanks to the recovery of the labor market. With the government’s “speedy” vaccination policy, workers can return to work with peace of mind thanks to the high vaccination rate. Not only that, the policies to increase the welfare of enterprises and the policy to support employees of the State also contribute to bringing the production activities of the textile and garment industry back to normal.

Vietnam’s food and beverage market was one of the most attractive markets globally (ranked 10th in Asia) in 2019 as per BMI. Total sales of food and beverage reached US$41.7 million (+ 3.8 percent YoY) in 2020. In this article, we explore the driving factors behind the growth of Vietnam’s food and beverage industry.

Vietnam is well known for its varied cuisine, which has reached markets around the world, from London to New York, and from Moscow to Johannesburg. Food from northern Vietnam emphasizes freshwater ingredients, such as fish, mollusks, and crab, due to geographic restrictions on spice growing and cattle rearing. Central Vietnam boasts of strong flavors enhanced by chili peppers and other spices. While southern Vietnamese cuisine incorporates bounteous fruit and vegetables, with fresh herbs, seafood, and frequently coconut milk.

Regardless of its cuisine’s global fame, Vietnam’s domestic food and beverage (F&B) industry is also steadily gaining in market value. The F&B industry had been growing at a fast rate before the Covid-19 pandemic, attributed to a cocktail of positive trends like population growth, increasing household incomes, and shifts in consumer behavior.

Presently, however, Vietnam’s F&B industry is recovering from the pandemic, which has globally impacted restaurants, cafes, and bars and daily consumption due to restrictions on public movement and open gatherings as well as temporary fiscal restraint shown by many in uncertain economic times.

IMPLEMENTATION REPORT OF INDUSTRIAL PROJECTS IN VIETNAM

The emergence of the 4th wave of Covid-19 starting from the end of April has taken a heavy toll on the country’s economy, causing serious damage to all economic sectors. Especially, in the third quarter of 2021, when the number of infections in many provinces and cities increased rapidly, the social distancing policy was applied in most major provinces and cities, Vietnam’s GDP in the third quarter of 2021 decreased 6.17% compared to same period of 2020, this is the lowest quarterly growth rate ever recorded from 2018 so far. In 2021, Vietnam’s GDP increased by 2.58% – the lowest growth rate since 2018.

The total value of foreign direct investment into Vietnam in the 12 months of 2021 reached 31.15 billion USD, increased 9.2% over the same period last year. In which, the value of newly registered capital and adjusted capital increased sharply compared to the same period last year, reaching USD 15.25 billion (up 4.1%) and USD 9.01 billion (increased 40.5%).

Continuing the trend from the beginning of 2021, the number of newly granted projects decreased by about 31.1% over the same period last year, but the total value of newly registered capital increased by more than 4.1%. If in the period of Q1 and Q2, although the number of newly granted projects decreased significantly, the newly registered capital increased sharply (> 16% compared to same period of last year), then in the 12 months, the value of newly granted capital increased only 4.1%. This shows that the trend of foreign investors who have registered to invest in large-scale projects still occurs from the beginning of the year to the end of 2021, but due to the complicated development of the Covid-19 epidemic in the third quarter of 2021 so by the end of the year, large-scale projects tend to increase but not as much as before.

The complicated evolution of the Covid-19 epidemic in Vietnam and around the world, leading to a disruption in the supply chain, continued to negatively affect the import and export activities, however, in the last months of 2021 with the vaccination campaign, loosening distancing measures, production has improved compared to the third quarter of 2021. Accordingly, the value of exportation for the whole year reached 336.25 billion USD (increased 19% over the same period last year), the value of importation reached 332.25 billion USD (up 26.5% over the same period last year). Vietnam has an estimated trade surplus of 4 billion USD in 2021.

The decrease in the number of FDI projects combined with the difficult situation in the implementation of construction projects, the high price of construction materials, was heavily affected by the epidemic with the social distancing policy, especially in Vietnam. The time of Q.3/2021 has caused many enterprises in the field of Industry and construction to be dissolved or temporarily stopped operating. The number of businesses dissolved and suspended in 2021 increased by 18% and 7% respectively compared to 2020). While the number of newly established businesses decreased by 22.4% over the same period last year and the number of businesses returning to operation also decreased by nearly 10%. In 2022, with the policy of “Adapting safely to the epidemic” – both safely fighting the epidemic, developing the economy and promoting production and business, combined with increasing public investment to promote the economy and to attract foreign investment, the operation of enterprises is expected to be better than in 2021, but businesses still need to develop a clear operating and financial plan to prevent the Inflation which may be increased further and raw material prices remained high.

Development Status of Viet Nam Industrial Projects in 2021

New FDI projects are still mainly located in the North and in the South. The projects in the Central region only accounts for a small number of registered projects, mainly projects in the processing and manufacturing sector. If in the South, the project showed signs of increasing in both quantity and value of invested capital in the fourth quarter after the decline in the third quarter, in the north, the third quarter was the peak period in terms of investment projects and has a decrease of about 13% in the fourth quarter compared to the third quarter in terms of the project numbers. In the Central region, the fourth quarter of 2021 is a prosperous time to attract FDI in the region with an increase of 267% compared to the number of projects in the third quarter, higher than that of the first and second quarters. Projects in the Central region are insignificant when compared to the South and North, but with the current rate and frequency of increases, we believe that the Central region will be an attractive destination for investors in the near future when the industrial land fund in the North and the South is dwindling.

In 2021, the number of industrial projects that rent ready-built factories (RBF) accounts for 21% of the total number of newly registered projects, the investment registration value of these projects’ accounts for 5%. The majority are still construction land lease projects.

Within the framework of the Report on the implementation of industrial projects in Vietnam in 2021, we focus on analyzing projects data which have the investment capital of more than 2 million USD (equivalent to 46 billion VND) that are in the process of being prepared for construction (Project preparation, Design, Bidding, Contractor selection. main) and projects under construction based on the following criteria: Type of construction, Locality, Type of project, Type of investment as of the end of December 31, 2021.

The total number of projects is 1386 projects with a total investment capital of approximately 126 billion USD, mainly projects in the project preparation stage, 997 projects, most of which are projects in the preparation for construction, bidding and in the design process with 795 projects with $97 billion in value deployed on more than 23 thousand hectares; selected projects include 202 projects; There are 389 projects under construction. Due to the complicated situation of the epidemic in the past year, it has greatly affected the project implementation, as well as the psychology of investors who are afraid of investing in project construction during the epidemic period, especially during the pandemic. In particular, the high price of construction materials will affect the overall cost, so most of the projects are still in the preparatory stages.

INVESTMENT REPORT VIETNAM'S AGRICULTURE & FEED INDUSTRY 9 MONTHS OF 2021

Although Vietnam is currently promoting the development of industry and service sector, the agricultural and fishery sector still plays the role as a pedestal of the economy during the pandemic. The GDP share of Agriculture and Fishery in total GDP of country increased not much but steadily through the first 03 Quarters of 2021.

The GDP of Agricultural and Fishery sector decreased in Q.I of 2021. But in Q.II these two sectors improved and increased 7% and 26% accordingly compared with Q.I. In Q.III, this was the most serious period because of Covid-19 pandemic, however the numbers recorded by these two sectors were still positive. Especially in 9 months of 2021, the agricultural and fishery sectors increased 34% and 23% compared with same period of 2020.

The agriculture and feed projects are located mainly in the South with more than 75% of project quantity, and 25% in the Central. Most of projects are ten of million USD in scale. There are no projects in the North in the first 9 months of this year. The South has favorable climate conditions, the average annual temperature is about 27°C, the terrain is flat, especially the Mekong Delta is mainly alluvial soil, the population is large, all is very suitable conditions for agricultural and fishery development. industry and fisheries. In the Central with the focus on investment in irrigation and infrastructure projects in the agricultural sector, it greatly contributes to the restructuring of central agriculture towards sustainability. In the North with high mountainous terrain, there is less area than other regions for agricultural development. However, the government is trying to promote the development of agricultural projects in the mountainous provinces, creating favorable conditions for the North to attract more attention from investors in this field.

The numbers of agriculture and feed FDI projects in 9 months of 2021 was not much. Vietnam recorded the largest number of registered projects and total registered capital in the Q.2. But then it decreased in the Q.3 due to the strong impact of the Covid-19 epidemic on production and business, especially human resource issues in the recent Covid-19 outbreak. Most of projects are invested by partners from Singapore, Thailand.

Among new licensed projects in the first 9 months of 2021, most of big registered capital value projects are located in Binh Phuoc Province, followed by Binh Dinh and Ba Ria-Vung Tau province. Vinh Long and Khanh Hoa were also in top of provinces attracting a lot of investment in agriculture and feed industry in Vietnam.

Projects are planned to be formed in the future

Our data shows that at the end of September 2021, in term of total investment capital, the expansion project is quite small compared to the new construction projects. However, the number and land area of expansion projects are much bigger than the new construction projects. This shows that more and more investors tend to expand production, but the scale is not too large. In addition, new construction projects are smaller in number, but the investment capital scale reaches great numbers. It can be seen that the trend of new investment in large-scale projects is still going on in the Vietnam market.

The agriculture and feed projects are located mainly in the South where have the highest project numbers. However, the project scale in Central is biggest compared to other regions, both in terms of the registered capital value and land area.

LOGISTIC SYSTEM – ESSENTIAL FOR ECONOMIC DEVELOPMENT

In recent years, the logistics system has become a top development priority of the Government of Vietnam. High logistics costs are one of the major barriers affecting the competitiveness of the Vietnamese economy. Whilst the economy is highly open, dependent on import-export activities and foreign direct investment (FDI), manufacturing and processing enterprises have been suffering the most from under-developed logistics system.

To catch that issue, we developed the Vietnam Industrial Real Estate Report Q1.2021, which focuses on analyzing the relationship between industrial real estate and logistic system for manufacturing.

The Vietnam Industrial Real Estate Report Q1.2021 comprises of the following main contents: The current development status of the Logistic system and its impact on the development of processing and manufacturing activities; Analysis of the existing and planning production bases, thereby forecasting the development trend of logistic system, especially warehouses and logistic centers.

Over the past decade, tourism has become more and more accessible to people around the world. Therefore, the tourism industry has made strong developments, especially in recent years. The economy is recovering and growing strongly, and the living standards of people in many countries have been enhanced, spurring spending on global tourism and accommodation services.

However, the economic downturn will take place about every five years, resonating with the impact of the Covid-19 epidemic, which predicts the tourism industry will suffer the most severe losses of all economic sectors.

Vietnam is one of the fastest growing tourist destinations in Southeast Asia. Thanks to many favorable factors such as the growth of tourists, new international hotel brands entering the market, the visa policy is relaxed and the development of infrastructure. However, the Covid-19 epidemic greatly affected the tourism industry, especially young countries like Vietnam. International tourists of Vietnam are mainly from Asia, countries such as China, South Korea, Japan, … these are outbreaks in the world, so the high-class hotel segment will lose revenue.

Rubber trees are grown mainly in Southeast Asian countries, Africa and a small part in the Americas. 5 countries Thailand, Indonesia, China, Malaysia and Vietnam currently have the largest planting area in the world. Output and export value of natural rubber decreased slightly in 2019 due to rising inventories. Forecasting in 2020, the consumption of natural rubber will decrease further due to the impact of Covid-19 epidemic.

In 2019, foreign investors continue to gain the upper hand in prominent M&A events in Vietnam’s real estate market. Retail: optimistic movements when the supply (in Hanoi) and the average absorption rate increase. Office: new supply is still coming from Grade B offices. Rents have increased steadily due to meeting customer requirements, with occupancy rates of over 90%. Industrial park: Constant supply. Occupancy rate, rent is constantly improving. Apartments for rent: Hanoi market in the fourth quarter with additional Grade A apartments, HCMC market. HCM did not record additional supply, prices and vacancy rates were maintained stable. Hotel: supply decreased in both areas, prices and occupancy rates increased sharply due to the increase in tourists. Apartments for sale: The supply has increased in both Hanoi and Ho Chi Minh City. HCM, sales increased due to the market demand is still very high. Villa, adjacent: Hanoi continues to record growth in both new supply as well as the number of units sold in the city. HCM City is in short supply again due to slow business licensing...

95% of the world’s leather material comes from the food industry and is directly affected by meat and dairy consumption. Over the years, China has become the largest leather producer in the world, followed by India, Brazil and the US. The world tanning industry is characterized by small or medium family businesses. Countries with the fastest growing tannery industries, such as Korea, Taiwan, China and Indonesia, have difficulty in supplying raw materials and have to import large quantities of raw leather. about 120,000 – 150,000 tons of raw leather.

The compound annual growth rate in the period of 2013 – 2019e reached 19.2%, in 2019 the production of leather (excluding synthetic leather) reached 144.9 million m², an increase of 23.5% compared to the same period in 2018. Leather production Domestic production is still low, meeting only 40% of the leather demand for export production, forcing businesses to import leather from abroad.

Supply: The country’s coal output in the first 3 months of 2020 reached 12.6 million tons, an increase of 7.9% over the same period last year, mainly due to the continued high demand of coal in the market.

Consumption: According to TKV, in the context of the situation of the Covid-19 epidemic, by the end of the first quarter of 2020, coal industry consumption still experienced a lot of positive, reaching about 24% compared to plan. Despite the high demand for coal in the first 9 months of the year, especially for electricity production; when hydroelectric plants faced difficulties due to lack of water, especially in the Central Highlands and Central Coast regions due to the impact of El Nino. However, domestic coal supply faces many difficulties and scarcity.

Please Login to use our services.

If you are not our member, please register here or contact us via email support@ipavietnam.org for our further support.

This language is being updated and will be released soon.

Thank you!

Thank you for sending us your request. For further assistance, please contact us via email support@ipavietnam.org or hotline +84-83-555-3388.

Thank you for sending us your request. For further assistance, please contact us via email support@ipavietnam.org or hotline +84-83-555-3388.