Vietnam ranks in top 5 favourite investment destinations among Asia’s emerging and developing countries

Vietnam has ranked in the top five favourite investment destinations among Asia's emerging and developing economies, according to the Global Opportunity Index.

The US' Milken Institute released the Global Opportunity Index (GOI) on March 5. The GOI remains a strong predictor of capital movements 10 years after its inception. The index alone explains 64.7 per cent of the variation in per capita foreign direct investment (FDI) inflows and 51.7 per cent of per capita portfolio inflows to countries across the world. The 2024 GOI report provides a global overview of countries' attractiveness and capital inflows.

Accordingly, Vietnam placed 65th in this year's ranking globally. Meanwhile, among Asian emerging and developing (E&D) economies, Vietnam proved an investor favourite and ranked 5th in the region, trailing behind Malaysia, Thailand, China, and Indonesia.

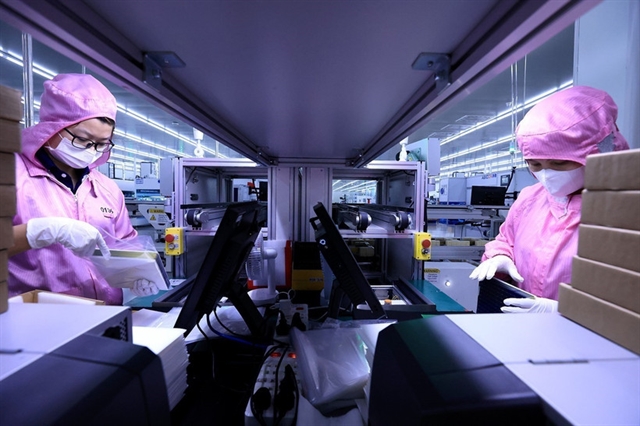

Over the past few years, Vietnam has become popular among foreign investors. According to the Ministry of Planning and Investment, Vietnam lured as much as $36.61 billion in foreign direct investment (FDI) capital in 2023, up 32.1 per cent on-year. Realised FDI rose 3.5 per cent from a year ago to hit $23.18 billion, a record level. In the first two months of 2024, FDI inflows into Vietnam totalled $4.29 billion, up 38.6 per cent compared to the same period in 2023.

“While advanced economies provide stability, investors seeking high-growth returns continue to show interest in emerging and developing economies,” said Maggie Switek, senior director at the Milken Institute and co-author of the report.

E&D Asia attracted more than half of the total capital flowing into E&D economies between 2018 and 2022. However, with growing tensions between the United States and China, capital inflows to E&D Asia dropped sharply by 75.4 per cent during 2022.

This year, Denmark claimed the top ranking, followed by Sweden and Finland. The US gained one spot on the index, moving up to fourth position.

To create the index, the Milken Institute evaluates investment opportunities through 100 variables organised into five categories and 14 sub-categories. The five major categories are: Business Perception, Financial Services, International Standards & Policy, Economic Fundamentals, and Institutional Frameworks.

By Thanh Van

Source: VIR

Original link